AI Market Dynamics: Open Vs. Closed, Direct Vs. Indirect

Understanding the AI Market Dynamics, to be or not to be!

The Generative AI bubble keeps getting bigger, and the landscape is more dynamic than ever, leaving no one behind, from the tech giants/the incumbents to new entrant startups. The net improvements in productivity and knowledge acquisition brought by GenAI are great for consumers. Additionally, the diversity and choice encourages competition, which leads to lower prices for all consumers.

That said, for someone who wants to understand the market or even start an AI business, it’s important to build awareness of the landscape, how those companies position themselves in the market, what the main products they sell, how they make money, and finally, how does AI contribute their business livelihood. That’s exactly what this post is about.

In this post, we will explore the AI Market Dynamics Quadrant. We will focus on how open or closed the offerings from those companies are when it comes to generative AI models (open vs. closed) and how coupled the models/GenAI in general are to their business model (direct vs. indirect).

The Glossary

We will be segmenting the AI market into four key categories based on two dimensions: the openness of the AI model (open vs. closed) and the integration of the AI model into the business model (direct vs. indirect sell).

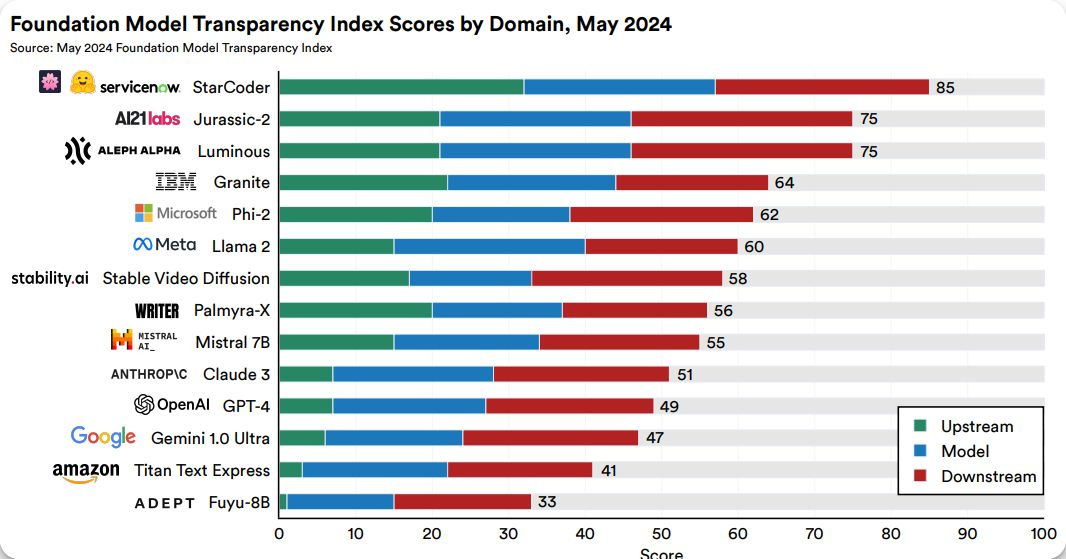

Open Models: AI models that are accessible to the public, often leveraging permissible licenses to share the weights, code, architecture, etc, or community licenses (with conditions), to encourage usage and contribution. They also usually rank higher in the foundational model transparency index.

Closed Models: AI models that are proprietary, with controlled access to ensure exclusivity and competitive advantage (the model here is usually the MOAT).

Direct Business Models: Companies that monetize AI models directly through subscriptions, licenses, or selling the technology itself. The model is the product!

Indirect Business Models: Companies that use AI models to enhance and complement their existing products and services, rather than selling the AI models directly. The model is the proxy!

These are all words you’ll need to follow along and understand the quadrant. That said, let’s try to get more insights into how the companies in the quadrant make money today before starting to analyze the dynamics and the landscape through the quadrant.

The Players: Incumbents & New Entrants

In the landscape quadrant, I didn’t include all the companies in the world. I sampled based on activity and heat, i.e., these are the top players potentially with the largest influence and diffusion power on the AI scene.

Let’s start with the incumbents, the well-established, those who know what they are doing, the seniors.

Sample Incumbents

Below is a sample of incumbents.

IBM

Software is IBM's largest revenue driver. It includes Watsonx (AI and data platform), Red Hat (Hybrid Cloud, RHEL, OpenShift Platform, and Ansible), security and zero-trust, automation, and transaction processing (which powers IBM Z).

In second place is IBM Consulting, which is a key driver for digital transformation for many organizations. It also partners with other large enterprises AWS, Microsoft, and SAP, and utilizes Watsonx for procurement solutions.

In third place is IBM Infrastructure, which ensures reliable, secure solutions for critical workloads across public, private, hybrid clouds, and the edge. Its strengths include transaction processing on IBM-Z and AI-driven transformation.

Finally, IBM financing which supports the acquisition of IBM's technology solutions and services by providing various financial options, including loans, leases, and customized payment plans.

Generally, generative AI models are not the main revenue stream here. IBM makes money by providing comprehensive tech solutions and transformation services and leveraging open-source models to drive consulting and software sales.

Microsoft

Microsoft generates revenue through a diverse range of products and services, primarily categorized into three main segments: Intelligent Cloud, Productivity and Business Processes, Personal Computing, and as of very recently, AI-enabled services. Here is a detailed breakdown of these revenue streams, followed by a simplified revenue distribution based on the available data:

Intelligent Cloud segment is Microsoft's largest revenue driver, which includes Azure (their cloud), SQL Server, Windows Server, GitHub, and Enterprise Services. Azure, in particular, is a major component, offering a wide range of cloud services and holding a 24% market share, second only to AWS. This segment accounts for 38% of Microsoft's total revenue.

Personal Computing is the second largest revenue driver. It encompasses Windows (operating system), Surface (devices), Xbox (gaming consoles and services), and search advertising (Bing). This segment aims to enhance the user experience across various devices and platforms. In 2023, this segment represented 25% of the total revenue.

Productivity and Business Process is the third largest revenue driver. This includes Office Commercial products and cloud services (Office 365), Office Consumer products and cloud services (Microsoft 365), LinkedIn, and Dynamics 365. This segment focuses on enhancing corporate productivity, communication, and information services. In 2023, this segment represented 23% of the total revenue

AI-enabled services, particularly through the Copilot platform, have become a major component of Microsoft's revenue streams. Copilot, integrated into Microsoft 365 and other products, leverages AI to enhance productivity and user experience. In 2023, AI-enabled services, including Copilot, comprised of 6% of Microsoft's revenue.

Generally speaking, Microsoft does not sell AI directly, it infuses it into their products/services like Office 365, search and Azure. It has also a pretty even and diverse set of revenue streams. Worth noting that the slightest capture in search from Google would yield considerable margins.

Google

Google's revenue model is more or less advertising driven, i.e., it remains by a large margin the primary source of Google’s income. However, it has diverse revenue streams. In addition to search and ads, it has Google Cloud, subscriptions, platforms, and devices, as well as its other bets segment (which gets rotated/killed often).

The diversity of Google’s revenue stream ensures it’s presence in both consumer and enterprise markets. Let’s do a brief break-down to understand a bit more (data from Alphabet’s q4 earnings report):

Advertising is Google's largest revenue driver, accounting for the majority of its income. This includes ads on Google Search, YouTube, and Google Network properties. In 2023, Google Search, YouTube, and Google network Ads contributed ~77% of Google’s total revenue (lion’s share).

Google Cloud comes in second place, which includes Google Cloud Platform (GCP) and Google Workspace. Google Cloud provides infrastructure, data analytics, and collaboration tools for enterprise customers. In 2023, Google Cloud contributed about 11% to total revenue, driven by the increasing demand for cloud services and AI tools.

Subscriptions, Platforms, and Devices are the third largest revenue driver. This includes revenue from YouTube Premium, YouTube TV, Google Play, and hardware sales such as Pixel smartphones and Google Nest devices. In 2023, this segment contributed 10.1% of the total revenue.

Other bets: Finally, Google's Other Bets segment includes various experimental and emerging businesses such as Waymo (self-driving cars), Verily (life sciences), and other innovative projects. Although this segment is smaller, it represented 0.7% of the total revenue.

Generally speaking, Google makes money through advertising, cloud services, and enhancing user retention across its suite of products. Google uses (or will use) AI models to improve its services, be it search, its Gsuite or its cloud offerings.

Compared to other incumbents, Google’s revenue stream might be diversified in numbers but not in weight. Google heavily relies on its Ads business, any threat to this stream canbe an existential threat to Alphabet/Google.

Amazon

Amazon's revenue model is characterized by its strong focus on e-commerce, cloud computing, and advertising. The company leverages its extensive product selection, efficient delivery services, and robust technological infrastructure to drive growth across various segments. AWS, in particular, plays a crucial role in Amazon's profitability, while advertising and subscription services continue to expand, contributing to the company's overall financial success.

Online stores are Amazon's largest revenue driver, which includes first-party sales of products directly to consumers. This segment accounts for approximately 40% of Amazon's total revenue. The online stores segment benefits from Amazon's extensive product selection, competitive pricing, and efficient delivery services

In second place are Amazon's third-party seller services, which include commissions, shipping fees, and other services provided to third-party sellers on Amazon's marketplace. This segment accounts for about 24% of the total revenue. The third-party marketplace allows Amazon to expand its product offerings without directly managing inventory, enhancing its overall product selection and customer experience

AWS is Amazon's cloud computing division and the third-largest revenue driver. It provides a variety of services, such as computing power, storage, and databases, to businesses and developers. In 2023, AWS accounts for approximately 16% of Amazon's total revenue. AWS is also the most profitable segment, contributing significantly to Amazon's operating income

Amazon's advertising business has experienced rapid growth, offering targeted advertising solutions to brands and sellers. This segment makes up about 8.2% of the total revenue. Amazon's advertising services include sponsored ads, display ads, and video ads, which help brands reach a wide audience on Amazon's platform

Amazon's subscription services, including Amazon Prime, Kindle Unlimited, Amazon Music, and Audible, are another revenue stream. In 2023, subscription services represented about 7.1% of the total revenue. Amazon Prime, in particular, fosters customer loyalty and drives additional sales through its ecosystem of benefits.

Amazon's physical stores, including Whole Foods Market and Amazon Go, accounted for approximately 3.5% of the total revenue in 2023. These stores complement Amazon's online presence and provide additional channels for customer engagement

Finally, Amazon's "Other" segment, which includes various smaller revenue streams such as co-branded credit card agreements and certain licensing and distribution of video content, makes up about 0.8% of the total revenue

Amazon's diverse revenue streams, including online stores, AWS, subscription services, and advertising, allow it to withstand losses in other areas due to its well-rounded portfolio, making it less dependent on AI. That said, in the AI world, AWS exposes a family of models through AWS bedrock led by Anthropic’s Claude, to which it has committed up to $4 billion in investments, and provides infrastructure through inferentia and trainium for inference and training, amongst the normal storage/compute/networking and the wide selection of instances. We will talk more about Anthropic and Claude in a bit.

Apple

Apple's business model is centered around product design and vertical integration. Apple’s focus on user experience and design, helped it build a brand with high equity, resulting in a very high willingness to pay from its customer base (especially as you own more Apple devices the value offered becomes higher). The company's revenue streams are diversified, with the iPhone being a major driver, supported by services like Apple Music and the App Store, as well as other products like the iPad, Mac, and Apple Watch. Here is a quick breakdown (sources: How Apple Makes Money and Apple Statistics):

Apple's largest revenue driver is the iPhone, accounting for around 52% of the company's total revenue.

Apple's Services are second, representing approximately 22% of total sales. Services include the App Store, Apple Music, iCloud, Apple TV+, Apple Arcade, and various other subscription offerings.

The third largest revenue contributor is Wearables, Home, and Accessories (10.4% of total revenue). This segment encompasses products like AirPods, Apple Watch, HomePod, Apple TV, Beats headphones, and other accessories.

Next is the Mac lineup of computers, including MacBook Air, MacBook Pro, iMac, and others making up around 7.7% of Apple's total sales.

Finally, the iPad tablet lineup, consisting of models like iPad Pro, iPad Air, and iPad Mini, contributing about 7.4% of Apple's revenue.

Apple has been lurking in the shadows when it comes to AI compared to other incumbents, but the company has made significant investments in this area. Since 2017, Apple had 32 AI startup acquisitions under it’s belt, focusing on technologies like self-driving cars, voice design, music generation, and image recognition. These investments have led to the integration of AI features across Apple's product lineup, such as personal voice, live voicemail transcription, and advanced health monitoring on the latest iPhones and Apple Watches. Apple should also not be take lightly when it comes to the potential for personalization with AI, after all they ace the wearables!

Apple's AI strategy involves a hybrid approach, leveraging both in-house and external resources. The company is investing in generative AI and plans to "break new ground" in this area, as stated by CEO Tim Cook. Apple is also exploring partnerships with AI companies like OpenAI and Google to integrate their large language models into future products and services.

In summary, Apple's revenue model is driven by its diverse product (mostly physical) lineup, with the iPhone and Services being the primary contributors.

Meta

Meta's revenue model is dominated by advertising, with growing contributions from Reality Labs, Payments, and Other Fees. Let’s break it down:

Advertising is Meta's largest revenue driver, generating approximately 98% of the company's total revenue. This includes ad placements across its family of apps, such as Facebook, Instagram, Messenger, and WhatsApp. Meta's advertising revenue success is driven by its sophisticated ad targeting, large user base, and continuous enhancements in ad formats and measurement tools.

Reality Labs, Meta's division focused on virtual and augmented reality, generated around 2% of total sales. This segment includes hardware like Oculus VR headsets and software related to the metaverse. Despite still being a smaller revenue contributor, Reality Labs is a significant part of Meta's long-term strategy to lead in the development of the metaverse and immersive experiences.

Meta's Payments and Other Fees segment makes up less than 1% of the company's total revenue. This includes fees from Facebook Pay, peer-to-peer payments, and other financial services. Although currently a minor part of the revenue mix, Meta is investing in expanding its financial services offerings to create new revenue streams.

Meta's revenue model is dominated by advertising, with growing contributions from Reality Labs, Payments, and Other Fees. That said, Meta has been an active contributor (actually a solid contributor, e.g., PyTorch, Llama, etc.) to the AI scene.

AI is not the direct sell, nor it is the main revenue stream, but making one of Meta’s dependencies a commodity (the foundation model), helps it scavenge talent from the entire tech landscape to make its models better. In doing so, it helps it make material improvements for its ad business via better content recommendation, enhanced ad targeting, automatic content moderation, translation, and copy creation. As ad performance improves, Meta attracts more advertisers and commands higher ad rates, ultimately boosting their revenue. Not to mention that Meta’s “open” approach enhances their brand reputation and attracts top talent.

Summary for Incumbents

Technology incumbents like IBM, Microsoft, Google, Amazon, Meta, and Apple have long-established revenue streams from their core businesses, such as cloud computing, operating systems, search engines, e-commerce, and social media. They have existing means to make money (not AI). AI can be important in these industries mainly as an enabler for their core business and revenue streams but is not the main source of income.

There are exceptions, though. For example, Google is in the Ad business. Ads happen when you are able to connect the consumer with the advertiser. Google does this by offering “free” search (after selling the soul) and then surfacing Ads customized to the consumer. Facebook collects data based on social browsing and customizes ads (via cookies, again selling the soul) to improve click-through rates and bring them to the consumer, and so on.

In that case, where there is no actual product/software/service being sold but the Ad (as the main source of revenue), AI can be detrimental. If there is a better way to connect the consumer with the advertiser, it becomes a threat, hence why Google/Meta are strong players in the AI and foundational models game besides the AI new entrants (we talk more about those next) whose main mission in the world is to thrive of generative AI.

Below is an aggregation of incumbents' revenue stream distribution charts. If you look closely, you will see that there are a few with a balanced staircase distribution where all the streams are contributing their fair share to the aggregate revenue (e.g., IBM, Microsoft, Amazon, Apple). On the other hand, there are those that rely heavily on one stream (e.g., advertisement) to varying degrees (Meta wins in its sole dependence on Ads, followed by Google!).

Also, some have their streams under one category (e.g., Apple is focused on devices, wearables, and physical products), while others horizontally surf different verticals (cloud, e-commerce, devices, etc).

Better quality of the revenue distribution image here: https://github.com/thetechnomist/chartedterritory/blob/main/04_ai_market_dynamics/AI_market_dynamics_reveneue.pdf

Sample New Entrants

Below we will cover new entrants in the tech and AI scene. They don’t necessarily make money (profit) at this point, but we will quickly cover their business model to understand better how they fit in the AI Market Dynamics quadrant.

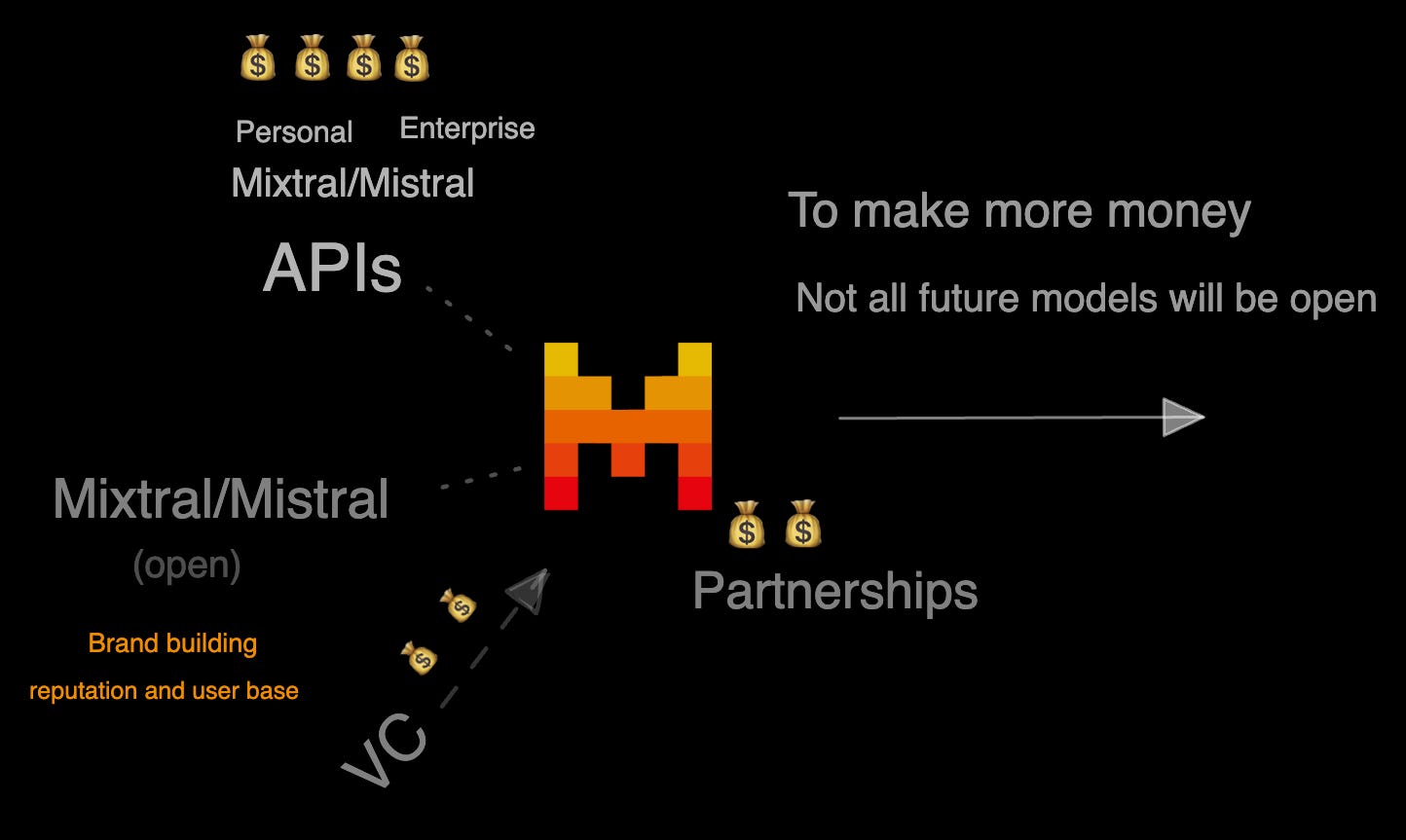

Mistral

Mistral AI's revenue model is driven by its AI models and services, enterprise solutions, and open-source offerings. The company's investments in AI research and its partnerships with leading tech firms have positioned it as a key player in the AI industry, with a strong focus on performance, efficiency, and customization. Let’s do a quick breakdown:

AI models and services are Mistral AI's largest revenue driver. This includes their flagship models like Mistral Large and Mixtral 8x22B, available through APIs and platforms such as Amazon Bedrock and Google Cloud's Vertex AI (also on Azure as of recently). These models serve various applications, including text summarization, question answering, and code completion. Mistral’s key play here is high performance and cost-efficiency for their models.

In second place are Mistral AI's enterprise solutions, which provide tailored AI capabilities to businesses across various industries. These solutions include custom AI development and fine-tuning services, allowing enterprises to adapt Mistral's models to their specific needs. Mistral AI collaborates with European integrators and clients to co-build solutions, ensuring that the models meet industry-specific requirements and compliance standards

Generally, Mistral focuses on providing open AI models through APIs and partnerships. They generate revenue through collaborations and by offering services that integrate their open AI models into other businesses.

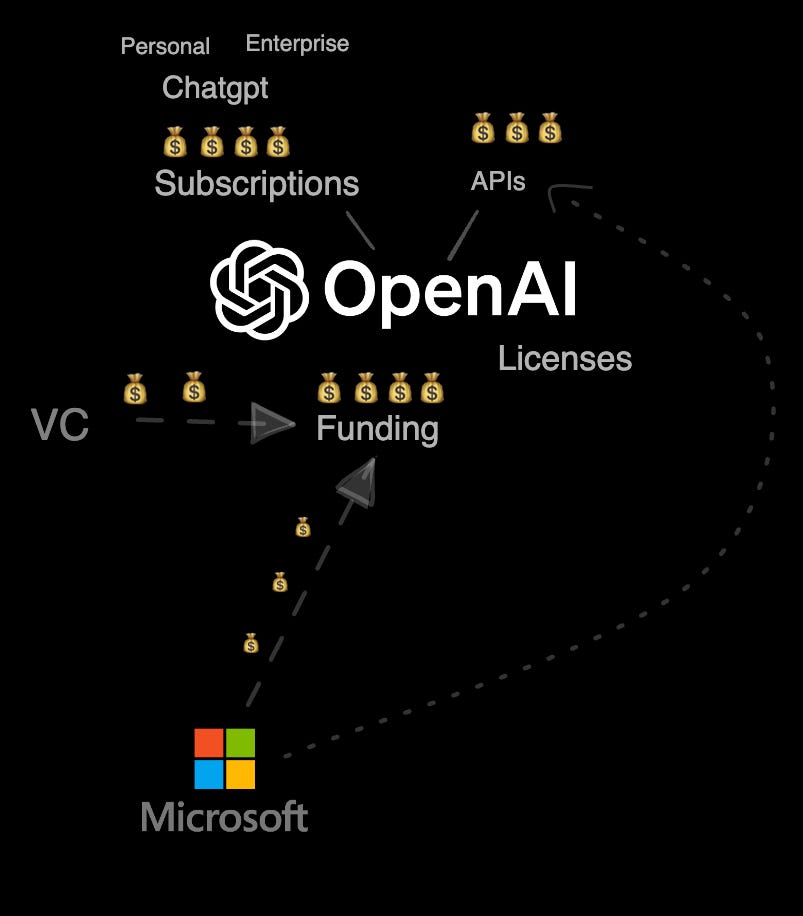

OpenAI

OpenAI, which began as a research lab in 2015 and transformed into a for-profit organization in 2019, generates revenue primarily through API consumption fees for its foundational models (the GPTs), used by startups, and even large enterprises to create AI-infused applications (mostly also for prototyping). But also, through premium/plus subscriptions which give access to more features like the create your own GPTs, the GPT store, better models (GPT4/4o/turbo/...), and more input/output tokens to use those models.

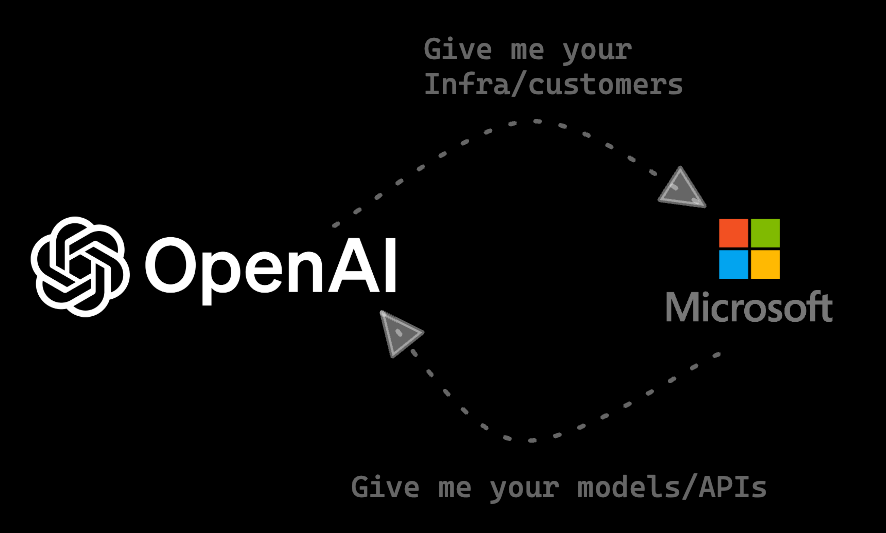

One of OpenAI’s largest partners/distributors is Microsoft, which is also a minority owner. In that case, Microsoft earns revenue through hosting OpenAI's APIs on Azure and distributing them to users, as well as through the sale of applications built on Azure. The partnership between OpenAI and Microsoft has led to new products like GitHub Copilot, and OpenAI's generative models may be integrated into Microsoft's offerings like Bing, Office 365, and now CoPilot + PC (similar to rewind.ai but eats more data, stay put and take care of your data 🙂).

On the other hand, Microsoft Azure serves as the foundation for OpenAI's AI infrastructure, enabling the pre-training of models, and OpenAI's APIs are distributed through Azure, allowing users to access them directly or through the Azure Enterprise platform (a wider variety of users).

OpenAI also has a somewhat spaghetti corporate structure. We will not discuss it in this post, but I left the diagram below for your own leisure.

Control Alt delete: Exploring OpenAI's corporate structure, after Sam Altman’s shock dismissal

In general, OpenAI uses a closed model, offering products like ChatGPT through subscriptions, APIs, and licenses. The main monetization is achieved through direct sales to personal and enterprise customers. I.e., the model is the product!

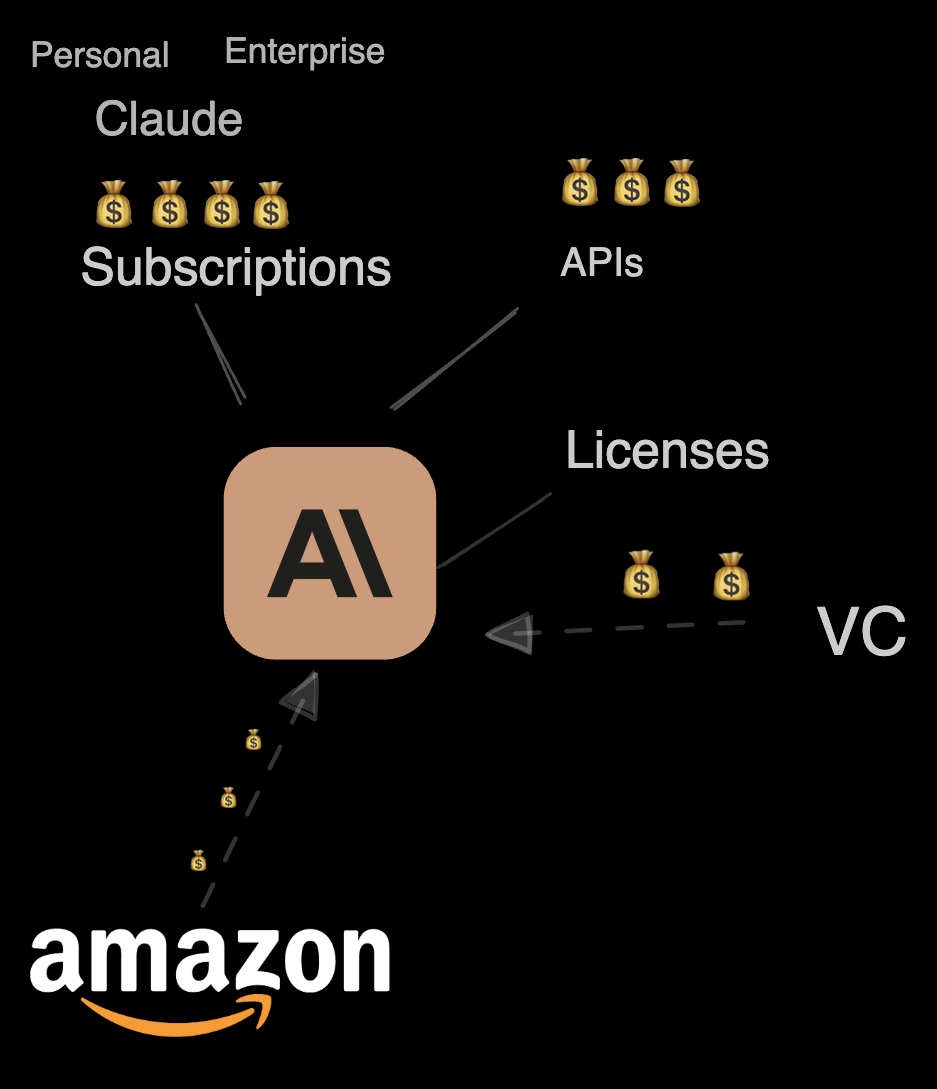

Anthropic

Like OpenAI, Anthropic's revenue model is driven by its mostly AI services, enterprise solutions, and custom AI development. The company's investments in AI research and its partnerships with leading tech firms have positioned it as a key player in the AI scene. Their AI game is around safety and ethical AI deployment.

Here is a quick breakdown:

AI services are Anthropic's largest revenue driver. This includes the Claude family of models, such as Claude 3 Opus, Sonnet, and Haiku, which offer AI capabilities for tasks like reasoning, content creation, and coding. These models are available through APIs and platforms like Amazon Bedrock and Google Cloud's Vertex AI.

In second place are Anthropic's enterprise solutions, which provide tailored AI capabilities to businesses across various industries. The Team plan, for example, offers access to all three of Anthropic's latest Claude models with expanded usage limits, admin tools, and billing management. This plan is designed to support multi-step conversations and process lengthy documents targeting sectors such as technology, financial services, legal services, and healthcare. The Team plan costs $30 per user per month.

The third-largest revenue contributor is custom AI development, where Anthropic collaborates with clients to develop bespoke AI solutions (individual clients design custom AI solutions). This includes dedicated capacity options for high-throughput needs, ensuring that clients can access the necessary resources to support their extensive AI applications (I.e., the infrastructure required to build customized AI solutions).

To add, similar to OpenAI and Microsoft, Anthropic and AWS are strategically collaborating with AWS becoming Anthropic’s primary cloud provider. Earlier in 2024, Anthropic made a $4 billion investment in Anthropic, securing minority ownership in the company. Anthropic is set to use AWS’s infrastructure (including AWS’s Trinium and Inferntia chips) to build, train, and serve its foundation models. This gives AWS early access to Anthropic’s models (with options to customize/finetune) and exposes Anthropic to AWS's massive customer base. The models are available through Amazon Bedrock. The play here is mainly centering around responsible AI as a differentiating tenet.

Generally, Anthropic provides closed AI models, focusing on products like Claude and recycles that as subscriptions for directly interacting with the models, through API consumption, or licenses for partners to use their models, which benefits both the partner and Anthropic. The main monetization is achieved through direct sales to personal and enterprise customers. I.e., the model is the product!

Summary for New Entrants

In a sense, the business models for Mistral, OpenAI, and Anthropic are quite similar. Subscriptions, APIs, and partnerships with one of the incumbents to give them access to people and infrastructure. Each tries to go for a unique play. Anthropic goes for ethical and responsible AI, Mistral goes for lean, efficient, and open models, and finally, OpenAI goes for AGI and best-in-breed quality.

That said, they all have one thing in common. Unlike the Incumbents who have various revenue streams making them money and can potentially loss-lead for a long while, this group operates on the basis that the model IS the main product and the revenue stream. Take the model away, poof, they are gone, finito!

Analysis & Categorization

No, let’s summarize all the above and explain the quadrant. There will be four categories, namely:

Open & Direct: Companies that pushed their foundational models to the open, and still rely on the model being the product.

Open & Indirect: Companies that pushed their foundational models to the open, but don’t rely on the model being the product, rather the proxy.

Closed & Direct: Companies that DID NOT push their foundational models to the open, and still rely on the model being the product.

Closed & Direct: Companies that DID NOT push their foundational models to the open AND don’t rely on the model being the product, rather the proxy.

Better quality is available here: https://github.com/thetechnomist/chartedterritory/blob/main/04_ai_market_dynamics/AI_market_dynamics.pdf

Open and Direct

Mistral is located here, among other new players (which are out of scope for this post). Mistral focuses on providing open AI models directly through APIs and partnerships, as described in the new entrants overview. Whether that will sustain a living or not is unclear for now, but they are definitely moving more towards offering their premium models (time leaps ahead) with a higher price tag, and they won’t be planning to open-source those models.

Open and Indirect

IBM and Meta fall here.

IBM utilizes open AI models (while wearing its open-by-default Red Hat to provide accessible training/finetuning via InstructLab) within its broader suite of software and consulting services. It enhances its offerings by integrating open-source models and providing comprehensive tech solutions without directly selling the AI models or at least not as their main revenue stream. IBM pushed their Granite models weights/arch/.. under the Apache license (a very permissive license). IBM also ranks highly in the Model Transparency Index (as of May 2024).

Similarly, Meta, which relies mainly on Ads to make a living, is releasing its models under a community license. In doing so, it gets contributions from the entire world to improve its internal services (for ad targeting), which helps it attract more advertisers and command higher ad rates, ultimately boosting its revenue. Not to mention that Meta’s “open” approach enhances its brand reputation and attracts top talent.

You might have noticed that I didn’t mention the eye of Sauron (Jensen Huang / Nvidia). I didn’t feel I needed to, they are right in the middle of it (see the quadrant), and no matter what happens, their chip rules them all (for now)!

”𝘍𝘰𝘳 𝘦𝘷𝘦𝘳𝘺 $1 𝘴𝘱𝘦𝘯𝘵 𝘰𝘯 𝘕𝘝𝘐𝘋𝘐𝘈 𝘈𝘐 𝘪𝘯𝘧𝘳𝘢𝘴𝘵𝘳𝘶𝘤𝘵𝘶𝘳𝘦, 𝘤𝘭𝘰𝘶𝘥 𝘱𝘳𝘰𝘷𝘪𝘥𝘦𝘳𝘴 𝘩𝘢𝘷𝘦 𝘢𝘯 𝘰𝘱𝘱𝘰𝘳𝘵𝘶𝘯𝘪𝘵𝘺 𝘵𝘰 𝘦𝘢𝘳𝘯 $5 𝘪𝘯 𝘎𝘗𝘜 𝘪𝘯𝘴𝘵𝘢𝘯𝘵 𝘩𝘰𝘴𝘵𝘪𝘯𝘨 𝘳𝘦𝘷𝘦𝘯𝘶𝘦 𝘰𝘷𝘦𝘳 4 𝘺𝘦𝘢𝘳𝘴" ~ 𝘕𝘝𝘐𝘋𝘐𝘈 𝘊𝘍𝘖

From silicon to software, each layer of the stack adds value by leveraging the "𝘳𝘢𝘸 𝘮𝘢𝘵𝘦𝘳𝘪𝘢𝘭" of the layer below. For the cloud providers (IBM, AWS, GCP, Azure, etc.), the raw material is the NVIDIA chip (or the AMD, Intel, etc.). For the Model/Inference API providers like Claude/OpenAI/Mistral, it's the infra to train/serve. For startups, wrappers, and application providers, it's the inference APIs, and the chain continues.

The success of the provider hinges on the success of the consumer and vice versa with varying dependencies.

One CHIP to rule them all, one CHIP to find them, One CHIP to bring them all, and in the darkness bind them; In the Land of GPUs where the shadows lie.

That’s it! If you want to collaborate, co-write, or chat, reach out via subscriber chat or simply on LinkedIn. I look forward to hearing from you!